When looking for your new Camden apartment home, there are many important elements that you must take into consideration. Some of these elements will be the location, size, and interior of the apartment; although one of the most important details that may be overlooked when searching for an apartment home is how much you should budget for rent.

Developing a budget can help you live more comfortably and plan accordingly for your future. Prior to apartment searching, make sure to ask yourself, “How much rent can I afford?” As an apartment dweller myself, who has worked as a community manager and now as a financial analyst, here are my helpful tips to help ensure you find the perfect Camden apartment home within your budget!

Budget Goal

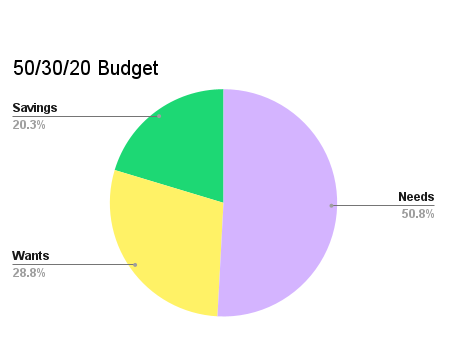

A general rule to follow when budgeting is the 50 –30 –20 rule. This rule states that within your budget, 50% is spent on needs, 30% on wants, and 20% on savings.

Within the 50% for needs, you will need to take into consideration your rent payment and any other needs within your life. – This includes necessities such as groceries, utility bills, medication, and even pet food.

When budgeting for your new apartment home, make sure your rent does not supersede your budget when including all your necessities.

Photo Courtesy of Bobby Sheppard

Breaking Down Your Budget

Using the 50-30-20 budgeting rule, with an income of $4,000 a month, you can budget $2000 for needs, $1,200 for wants, and $800 for savings. The general amount recommended by financial advisors to spend on your rent is 30%-35% of your income, which leaves about 15-20% remaining for other necessities.

Write out all your current monthly spending needs by listing out all your potential utility costs, groceries, and any other needs. The unknown cost of utility usage can be intimidating when creating a budget prior to moving, although you can search up the typical utility usage rates in the area you’re moving to for a close estimate.

Also, keep in mind to remain conservative with your utility usage to keep your budget more open – check out this Camden Blog on 5 simple water-saving tips for apartment living.

Find a Roommate!

Living with a roommate can be a great financial decision. This can cut your overall rent expense in half as opposed to living by yourself. A general two-bedroom will cost more than a one-bedroom, although the rent split in half can help make your overall rent spending less than that of a one-bedroom by yourself.

The idea of living with a roommate can be intimidating, so check out this Camden Blog on 8 easy tips to make sure you stay roommates!

Photo Courtesy of Camden

Stay Savings-Focused

A clever way to increase your overall savings would be to switch the “30” and “20” within the rule. Here, you will increase your savings to 30% of your income and 20% for your wants. This requires more discipline on your spending, but it can help you reach your saving/investing goals a lot sooner!

Overall, having a structured budget can help make things less stressful and can help you feel more in control of your life. A well-developed budget will help you find your perfect Camden apartment home with a lot less stress after moving once you’re there!

Camden communities mentioned

Let's be longtime friends—subscribe today!